A Joint Message

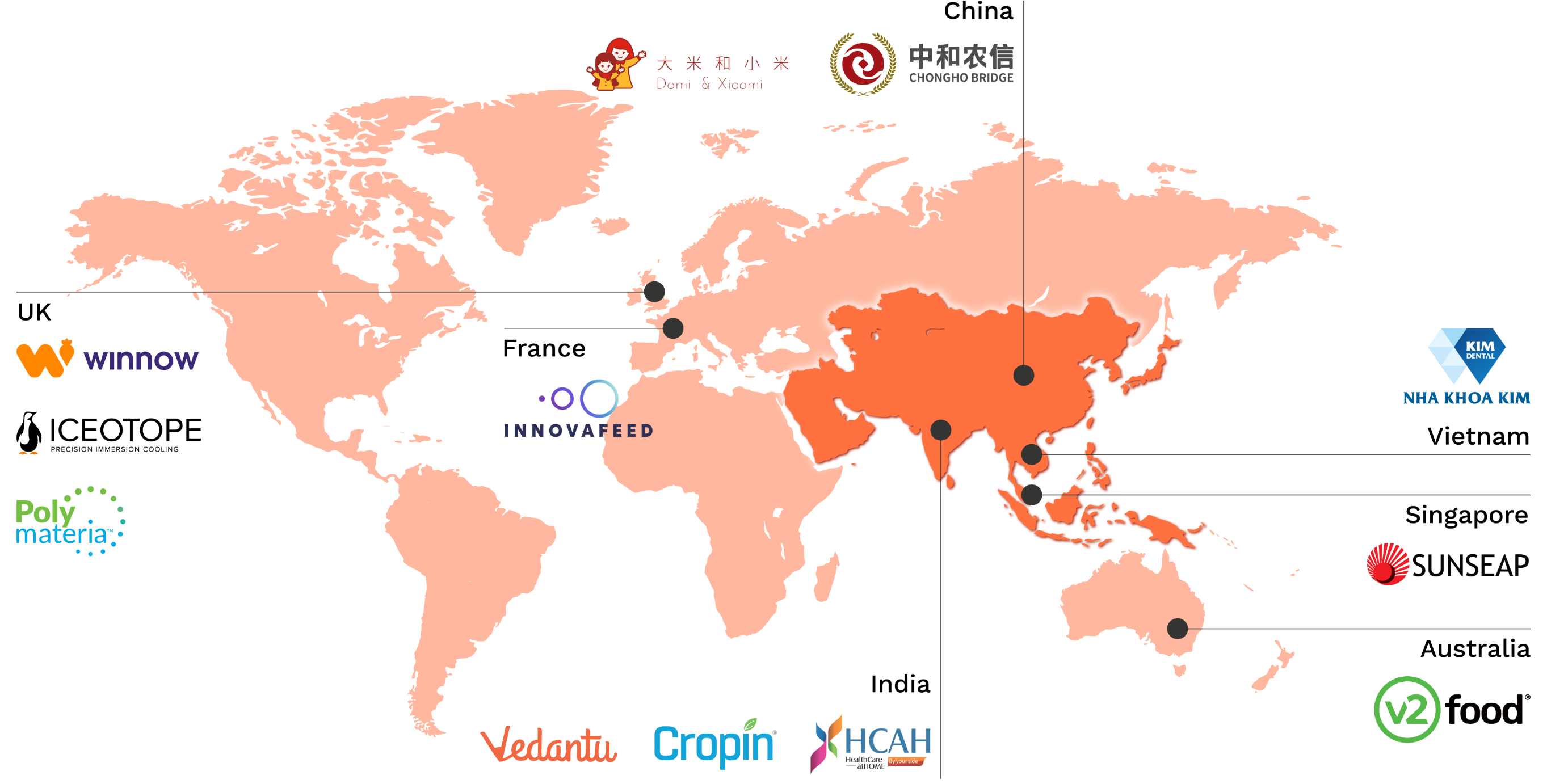

Global Focus,

Asia Purpose

At a Glance

Launch of Fund II

With a robust track record from our inaugural fund, we launched Fund II in August 2023 and secured over US$550 million in our first closing. This underscores the support and confidence investors place in our disciplined and evidence-based investment strategy. As we look towards the final close of Fund II in 2024, we remain steadfast in our mission, forging partnerships with likeminded investors to drive lasting positive impact on communities and the environment across Asia.

Impact Highlights

Bridges to Excellence: Certifications and Collaborations

In the vibrant landscape of impact investing, authenticity and accountability serve as guiding principles. At ABC Impact, our journey is marked by a deep-rooted commitment to both. Certifications and partnerships are vital threads weaving us into a tapestry of positive change. They validate our dedication to rigorous impact measurement and responsible practices, while also fostering connections within a community of like-minded visionaries.

In 2023, we achieved the B Corp Certification, a testament to our commitment to responsible practices. Additionally, we joined initiatives like the 2x Gender Initiative and the ESG Data Convergence Initiative, amplifying our connectivity and collaborative spirit within the impact investing community. These milestones reflect our belief that transparency, collaboration, and collective action are not only essential but also transformative forces in shaping a better future for all.

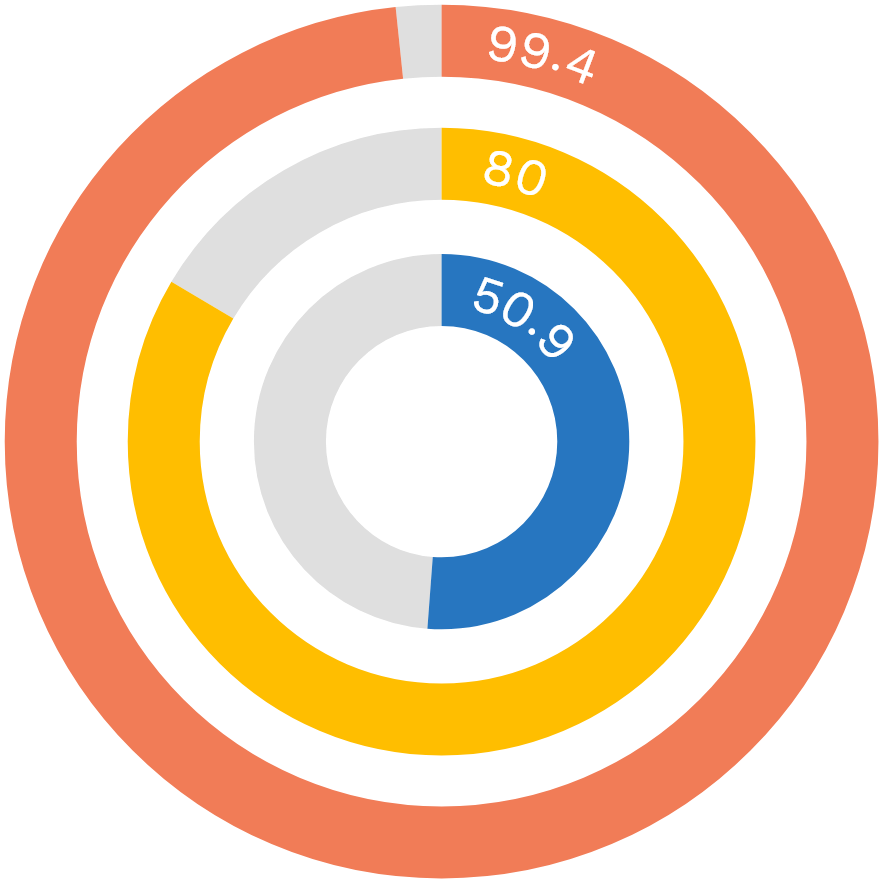

B Corporation™ Certification

Embedded within our investment process are core ESG (Environmental, Social, and Governance) factors, reinforcing our unwavering commitment to driving positive change while delivering sustainable financial returns.

The B Corp certification, awarded by the non-profit organisation B Lab, validates ABC Impact’s pursuit of impactful change across all our investments. This acknowledgment underscores our commitment to delivering tangible, measurable outcomes while driving continuous improvement. By affiliating with the growing B Corp community, we unlock access to a global network of kindred spirits, fostering collaboration and collectively shaping a future that is more inclusive, equitable, and sustainable.

Overall B Impact Score

“The B Corp certification and our journey to achieve it underscore our deep commitment to meeting high standards of social and environmental impact. We believe that finance can be a force for good, and we are proud to join the community of B Corp businesses worldwide who are helping to create a more inclusive, equitable, and sustainable world.”

David Heng

ABC Impact Investment Forum

Looking Ahead

While quantitative metrics provide valuable insights, impact investing demands a deeper examination. At ABC Impact, we recognise the significance of qualitative analysis and meticulous assessment in gauging the true difference we make in people’s lives and the environment. Consequently, we proactively pursue innovative approaches to address data scarcity, particularly in emerging Asian markets, so that we obtain more comprehensive impact validation throughout the investment cycle.

We prioritise addressing Asia’s most urgent social and climate challenges through our impact lens, while also aligning with long-term macroeconomic trends to promote sustainable growth.

Our portfolio comprises a balanced mix of social and climate investments spanning diverse markets across Asia, encompassing various stages of development. This strategy not only mitigates risk but also positions us to capture the vast growth potential inherent in the region.

Our Asia-based team brings extensive private equity experience to the table, coupled with a nuanced understanding of local customs and a well-established network throughout the region. This enables us to identify unique opportunities and navigate the complexities of the market effectively.

With extensive experience in deal analysis, ABC Impact operates with insights that enable us to strategically allocate resources for optimal impact and returns.